At Solvable, we're happy to share our knowledge on America's tax issues with the press. To request our expertise for your story on anything tax related from preparation to resolution, get an interview with our CEO or get a quote for your piece, please send us an email at media@solvable.com

In today’s media, there is a lot of discussion about the student loan and mortgage crises but the issue of unpaid back taxes, sometimes referred to as tax debt, is a topic that receives little attention – despite affecting over 11.2 million Americans, according to a 2019 IRS report.

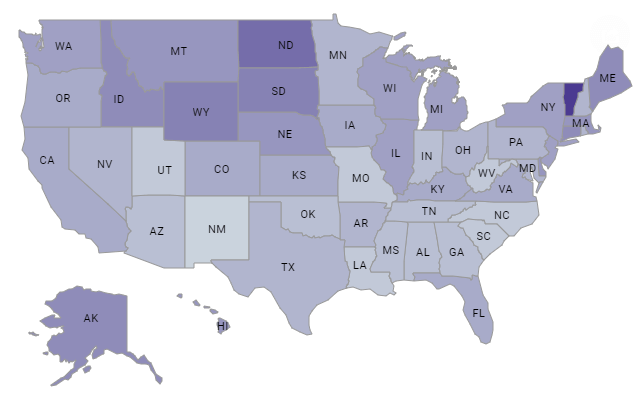

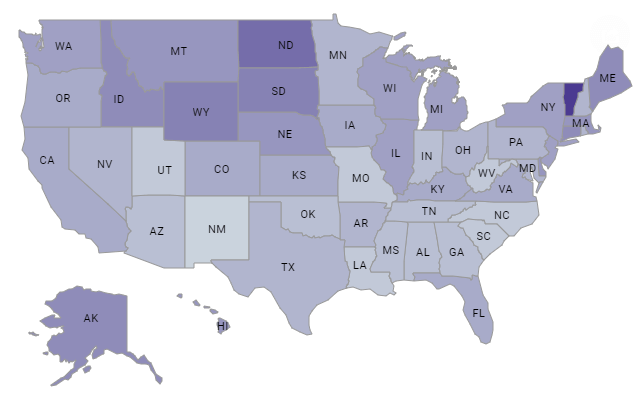

Using data from Solvable that featured 75,000 unique tax debt cases, LendEDU found average tax debt by state and the most common reasons for tax debt in each state.

While U.S. credit card debt and student loans tend to garner publicity, tax debt continues to be a massive problem that is overlooked.

Solvable, in collaboration with GOBankingRates, surveyed 1,229 Americans on their experience receiving government aid during COVID-19. The survey was broken down by employment type, and the makeup of responses is representative of the U.S. population, with responses from small business owners (14%), freelancers (10%), W-2 workers (65%) and retirees (11%).