Last Updated on

Case study reports are not necessarily representative of typical results that consumers may achieve. Individual results vary based on circumstances. Please read the important disclaimer at the end of this document.

“You’ve gotta help me! “They’re threatening to take my whole paycheck! I’m a truck driver and I can’t afford to pay them all that money right now!”

With these words – and one very smart phone call – Nick set himself on a path that would preserve his livelihood and settle his back taxes.

It was the evening of March 14, 2014. A night Nick will remember forever. He shut his P.O. box, hands trembling with anger and shock as they grasped the letters and plotted his next steps. And then it came to him. A radio jingle he’d heard countless times.

He didn’t even wait to leave the lobby. He pulled out his phone and called the number ringing in his mind. When you spend 300+ days of the year in your truck, you’re bound to remember more than a few commercials.

Fortunately for Nick, Community Tax Relief, a tax resolution company, was one of them.

Little did he know, this one fateful phone call would ultimately save him close to $40,000, which hungry Uncle Sam was trying to collect.

Just five years earlier, Nick left his W-2 job to start a new gig working for one of the most well-known trucking companies in the U.S.

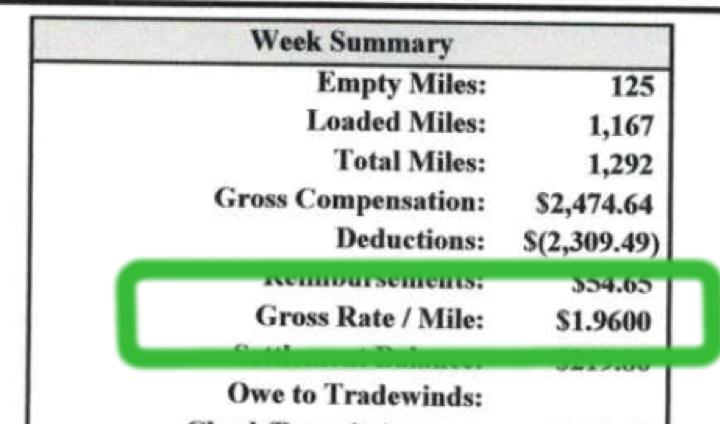

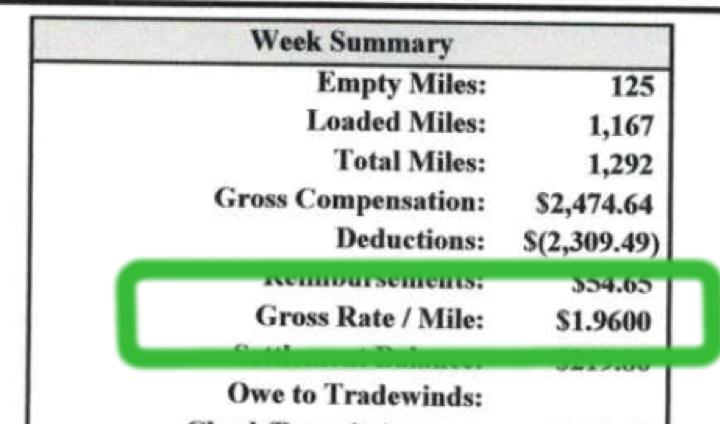

Almost everything in the agreement that he cared about – especially the pay – sounded like a dream come true. (He’d be grossing $1.96 per mile).

Nick understood this new job, being a 1099 position (otherwise known as Self-Employed or “Independent Contractor”), lacked some of the perks of his previous W-2 gig.

Most notably, the tax game at the end of each year would change drastically. Unfortunately, Nick didn’t know how bad Uncle Sam can hit independent contractors. He attempted to prepare his own tax return at the end of his first year, just as he’d done in the past.

But the end result was not at all the same as in past years, when Nick filed as a W-2 employee and had the benefit of withholding taxes.

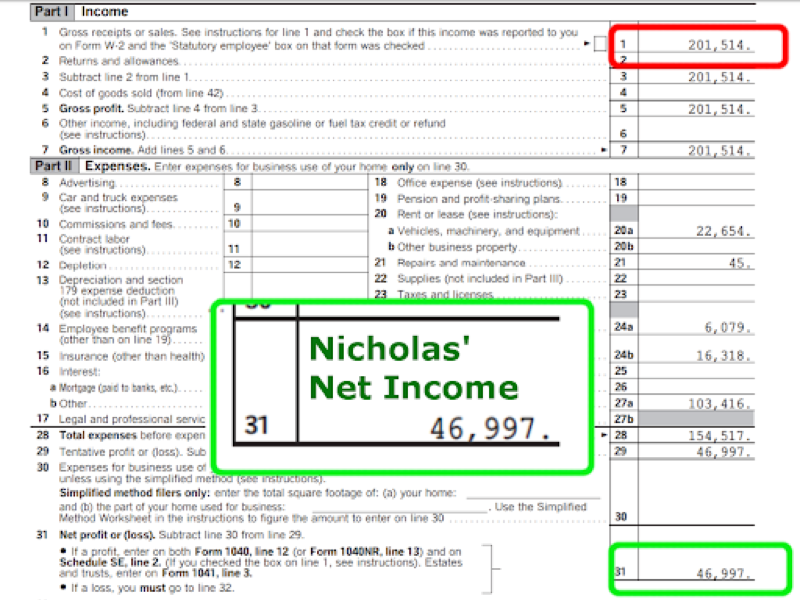

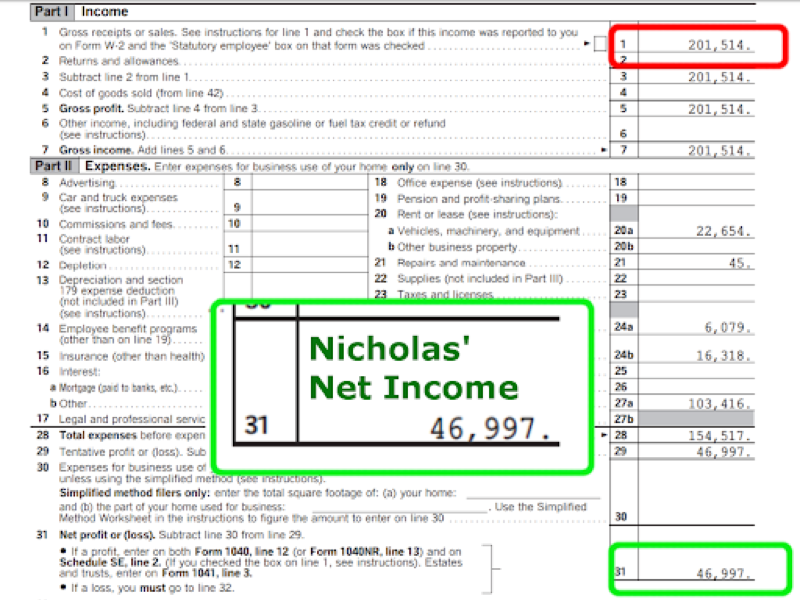

He meticulously filled in the boxes on the forms. Income went by income; expenses went by expenses.

Yes, the top-line earnings are impressive, but like many self-employed professionals, operating costs are far from cheap.

See More >> This Guy Resolved His $8,597 Back Taxes - Learn His Methods!

But he failed to take that into consideration. He neglected to write down smaller expenses and knew he couldn’t find receipts for all his fuel and lodging.

1099 contractors often forget to account for every expense, or don’t realize how many deductible costs go into running their business.

The result: A massive tax bill.

“This can’t be right! There’s no way I owe this much money!”

Feeling confused, embarrassed, and terrified, Nick chose to roll the dice and sweep the whole “You gotta file your taxes” idea under the bed in his big rig.

But what about April 15th?

Surely the IRS would come knocking on the door of his truck to collect, right?

Nope.

Maybe send him a letter to remind him he’s past due?

Not a thing.

A day went by…then a week…a month…a year…eventually, several years had passed and not one peep from the IRS.

Nick resumed his life and the idea of “having a catastrophic IRS issue” slowly faded into the depths of his rear-view mirrors.

At least, for a while.

Despite the dissolving tension of his looming IRS back taxes, Nick knew he would be called to answer for his inaction, eventually. On March 14, 2014, that day finally arrived.

His P.O. box in Indiana held multiple IRS letters reflecting back taxes from multiple years.

It was Nick’s reality check and call to action that he could no longer ignore his IRS back taxes. The IRS had caught up with him – as they always do.

See More >> How One Woman Crushed $300,000+ of Student Loan & Mortgage

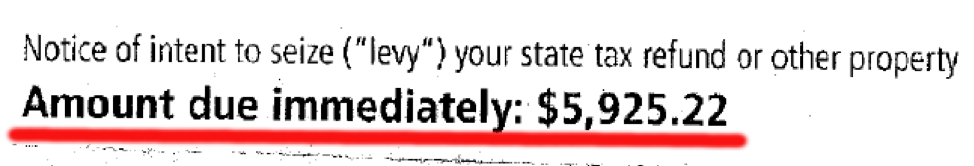

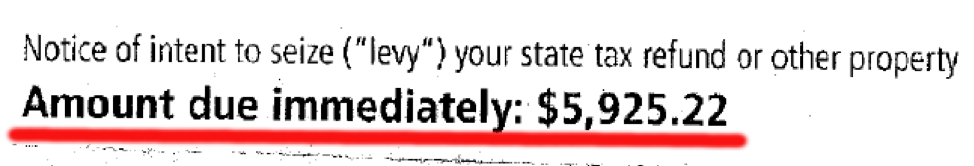

Each letter read: “Notice Of Intent To Seize Or Levy.”

Altogether, the IRS demanded $9,721, which was far more than Nick could come up with.

Although he’d made big, expensive mistakes ignoring his taxes for five years, he was a smart man. He knew the IRS meant business and he had no alternatives.

He had to take action.

Nick resolved to address his problem head-on and immediately called the IRS to negotiate an agreement.

Unfortunately, the IRS refused to work with him because Nick hadn’t filed his taxes in half a decade.

This is crucial. You may not enter into a formal resolution with the IRS until you are up to date with all Federal Filing Guidelines. More importantly, you are not protected from collective actions (i.e., wage garnishment, bank levy, asset seizure, etc.) until you are in a formal resolution.

Time was no longer any ally to Nick. He would be harshly penalized for every day he ignored his taxes and failed to face his problems.

The IRS has specific rules for 1099/self-employed contractors that do not apply to W-2 employees.

The IRS reserves the right to levy 100%…yes, 100%…of a self-employed individual’s paychecks until the full tax liability (including penalties and interest) have been paid.

This problem needed fixing …fast.

Fortunately for Nick, Community Tax has resolved virtually every kind of tax issue imaginable. To date, Community has worked over 50,000 clients (many of whom are also 1099 / Self-Employed) and resolved more than $540 million in back taxes.

Inspired by Nick’s tax challenge, the professionals at Community took the wheel to find a resolution.

The first step, of course, was to launch an investigation and gain clarity on the specific issues.

Infamously, taxpayers typically wait several hours to speak to a real person at the IRS.

See More >> I Paid off $150,000 - How I Did It!

Oftentimes, after getting through, they’re still unable to navigate the different departments to obtain the necessary information.

To fully understand the severity of Nick’s situation, Community needed to speak to an IRS representative directly, on his behalf.

Nick agreed that the best way to get to the root of the problem was for Community Tax to investigate his situation and represent him directly to the IRS.

Community Tax knew precisely who to call, and all it took was Nick signing IRS forms 8821 and 2848. Within a few hours, Community Tax had obtained a detailed summary of Nick’s case via his Master Tax File.

But the results weren’t optimistic. It may have been even worse than Nick imagined. Nick was missing tax returns for the past five consecutive years, and showed a pre-existing balance of $9,721 from several years of under withholding while working as a w-2 employee.

The question you’re probably asking yourself at this point is: “How the heck can Nick get five years of back taxes filed without having saved any of his receipts?”

Good question.

It was time for Community to enter Step 2 of the tax resolution process and help Nick file any and all required tax returns.

Including all of a driver’s expenses is the name of the game when it comes to filing as a self-employed truck driver.

In Nick’s case, if he relied solely on the expenses listed on his EOY report from his employer, his total balance would have equaled approximately $89,000.

Most people are allowed to deduct some amount of the expenses incurred with business travel. However, for truckers, nearly their entire lives are made up of business travel – from the foods they eat to the places they stay. Even their phone bill and WiFi usage may be a business expense.

Many self-employed individuals work with Community because the top-rated back tax assistance firm is well aware of common expenses they may accrue.

For truckers, this may include tires and other parts, routine truck maintenance, vehicle repairs, their CDL, meals per diem, health insurance, and many more.

Community Tax interviewed Nick to identify the documents needed, such as bank statements, and credit card statements to get his returns filed quickly and accurately.

After expenses, the Community Tax experts calculated that Nick’s net income was typically 20 to 25% of his gross.

See More >> Jen Paid Off $42,000 in Credit Card & Medical Debt...

Without the detailed expenses, the IRS could have taxed him on the full $200,000!

His back taxes dropped from $20,000 to a much more manageable $6,000 per year.

Nick was relieved to hear that Community Tax minimized his annual back taxes, but he was startled to learn that he now owed the IRS $39,378!

Remember, according to his IRS letter, his initial owed amount was $9,721. It was hard to believe, but quadrupling that tax liability actually represented significant progress in settling Nick’s back taxes.

Here’s why: The IRS requires taxpayers to be current in their tax filings to be considered for relief. So now that Nick was in compliance with this requirement, Community Tax could explore resolution options for him.

Nick called Community Tax because the IRS was threatening to garnish 100% of his paychecks until his $9,721 obligation was satisfied.

Imagine the crippling anxiety he was experiencing, now that he was on the IRS’ radar for nearly $40,000.

No bueno.

What Nick did not know, at this point, was that by having the courage to admit to his inadvertent wrongdoing, and by forcing an even bigger tax issue and greater back taxes, he was now in an even more favorable position to negotiate.

I know what you’re thinking: How could that even be possible?

If Nick’s lone self-employed income made it impossible to repay $10k, then $40k is obviously out of the question.

IMPORTANT FACT:

When negotiating with the IRS, it matters less what you owe, then what a reputable back tax assistance firm can PROVE you have the ability – or inability – to pay back.

At this point, we know a few things:

Most importantly, he has very little time before the IRS takes his paychecks…forcefully

See More >> Our Community Tax Expert Review

Any qualified tax practitioner who works with you on your financials, knows how much you owe, and understands your ability to repay, should be able to tell you what sort of back tax assistance you’re likely to qualify for.

The IRS has three primary resolution options, all of which offer protection from collections:

In Nick’s case, not only did Community Tax need an aggressive resolution to address the $40,000; they needed him to be in a protected status, to defend his upcoming paychecks.

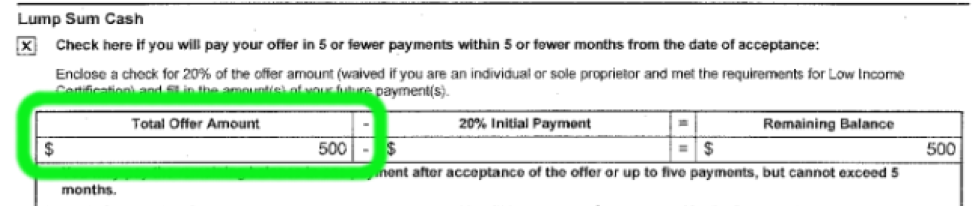

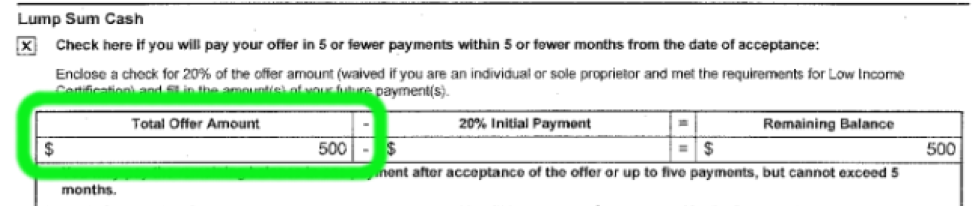

Nick’s financial statements indicated that he would be a perfect candidate for a $500 total settlement.

Community Tax submitted IRS Form 656 (above) which reflects Nick’s $500 settlement offer.

$39,378 to $500? 1.3% of his total owed amount? Doesn’t sound like a bad deal…

What’s even better is Community Tax understands how the IRS works, mechanically.

Similar to the way a driver knows when to shift gears.

The moment the IRS receives all of the necessary paperwork for an Offer in Compromise, that specific taxpayer is removed from the Collections Department, and placed in a temporary “protected status,” while an IRS Examiner reviews the paperwork.

This process usually takes 8-12 months, during which time Nick was fully protected from wage garnishments.

With the paycheck crisis avoided, there was finally hope on the horizon.

Months went by without a word from the IRS. Until one fateful day, the OIC Examiner reached out to Nick’s practitioner at Community Tax, with mind-boggling news…

The IRS was alleging that he owned eleven cars.

Those eleven vehicles were worth more than his $40k debt – meaning in the eyes of the IRS, Nick did not qualify for an Offer in Compromise.

But there was one problem. Nick sold those vehicles years ago.

It was time for Community Tax to launch into Step 4 of their tax resolution process: Negotiate to obtain the most favorable resolution option possible.

The OIC department is home to IRS Examiners. They have one job – to find reasons to reject OIC requests.

They’re pretty good at it. In recent years, the rejection rate has been as high as 75%*.

In the event they cannot find valid reasons for rejection, they might continue to request additional information in hopes that the taxpayer will either:

In any of these cases, your request can be severely delayed, or even outright rejected.

Are responses timely and satisfactory?

When an IRS Examiner requests more information, they want to ensure that responses are timely and satisfactory. If you fail to meet these criteria, they will reject your offer.

What’s more, the IRS Examiner is likely to reach out multiple times. Examiners are notorious for identifying numerous “discrepancies” in an effort to reject an OIC submission.

Community Tax didn’t take any chances. The back tax assistance firm representatives expected questions and disputes and responded swiftly and accurately.

Community Tax went back to Nick for additional fact-finding and discovered that he had sold all of his cars many years ago. As Community Tax stated in the initial OIC filing, Nick did not have the ability to repay his full balance. The firm reported this, with documentation, to the tax examiner.

On November 2nd, the IRS issued two letters.

One was sent to Nick. The other, to his tax practitioner at Community Tax.

Nick’s Offer in Compromise submission was accepted.

He couldn’t believe it.

$39,378 had been reduced to $500.

“So, that’s it? I pay them a $500 settlement, and it’s over?”

Good news, for sure. But his tax issues were not quite over.

IRS problems are a lot like potholes. Huge, obnoxious potholes.

It’s best to avoid them in the first place.

But if you do hit one, you want to remember where it is, so you don’t run over it again.

Let’s revisit the letter indicating that Nick’s Offer in Compromise was accepted.

Read the bottom paragraph…

“The conditions of the offer require you to timely file and pay all taxes for five years.”

According to the IRS, if you misstep, even just once, over the next five years – any non-expired back taxes comes back to life…and we’re back to the start.

Talk about being on a short leash…

In Step 5 of Community Tax’s expert back taxes resolution process, Nick would work with Community Tax to prevent future tax issues and design a prevention strategy to beat the IRS and ensure a permanent end to unmanageable back taxes.

First, Nick began tracking his expenses.

Most of the time, he tosses all of his receipts into a shoebox and mails the whole box to Community Tax to sort out.

Additionally, Nick relies on the experts at Community Tax, to ensure his taxes are filed accurately and on time, each year. In addition, Community Tax helps Nick file quarterly Estimated Tax Payments (ETPs).

It is recommended that 1099 Self-employed persons make quarterly payments to the IRS, in the form of Estimated Tax Payments (ETPs). These payments are treated like an escrow account and show the IRS you are acting as a responsible by not generating a massive tax bill at the end of each year.

While terrifying at first, Nick’s financial journey has brought him to a better place.

However, above all else…

The weight of the world has been lifted off his shoulders.

Just when he thought there was no road to redemption…

When all hope was lost, and he thought his only option was to run and hide…

He stepped up to the plate and took a chance by calling the experts at Community Tax for help.

And it worked.

If you haven’t filed all your taxes or believe you have more than $5,000 in back taxes, Solvable can help by connecting you with a back tax assistance firm like Community Tax.

Case Study Disclaimer

The story you have read here does not indicate or guarantee future performance or success of any other individual receiving Community Tax’s services or the services of any other back tax assistance firm. Solvable and Community Tax cannot guarantee that your back taxes will be lowered by a specific amount or percentage or that your back taxes will be paid off within a specific period of time. Roughly 18-21% of investigations completed by Community Tax result in a preliminary recommendation of an IRS Offer In Compromise settlement. Due to the length, time and complexity, roughly 8% of all resolutions obtained are settlements.

Individual results will vary based on circumstances – and the resolution process requires your full participation. In many instances, the outcome of an engagement with any back tax assistance service is simply a structured payout of taxes owed.